Unlock Exclusive Advantages With a Federal Lending Institution

Federal Cooperative credit union offer a host of exclusive benefits that can dramatically affect your financial health. From improved cost savings and inspecting accounts to reduced interest prices on car loans and individualized financial planning solutions, the advantages are customized to aid you save cash and attain your financial goals more successfully. But there's more to these advantages than just monetary perks; they can likewise offer a complacency and area that surpasses traditional financial solutions. As we explore better, you'll discover how these special benefits can absolutely make a difference in your financial journey.

Subscription Qualification Standards

To become a member of a federal lending institution, people have to fulfill certain qualification standards established by the institution. These criteria differ depending on the particular lending institution, yet they typically consist of aspects such as geographic location, work in a particular market or firm, subscription in a particular organization or organization, or family relationships to present members. Federal lending institution are member-owned monetary cooperatives, so eligibility needs remain in location to ensure that people that sign up with share an usual bond or organization.

Boosted Financial Savings and Checking Accounts

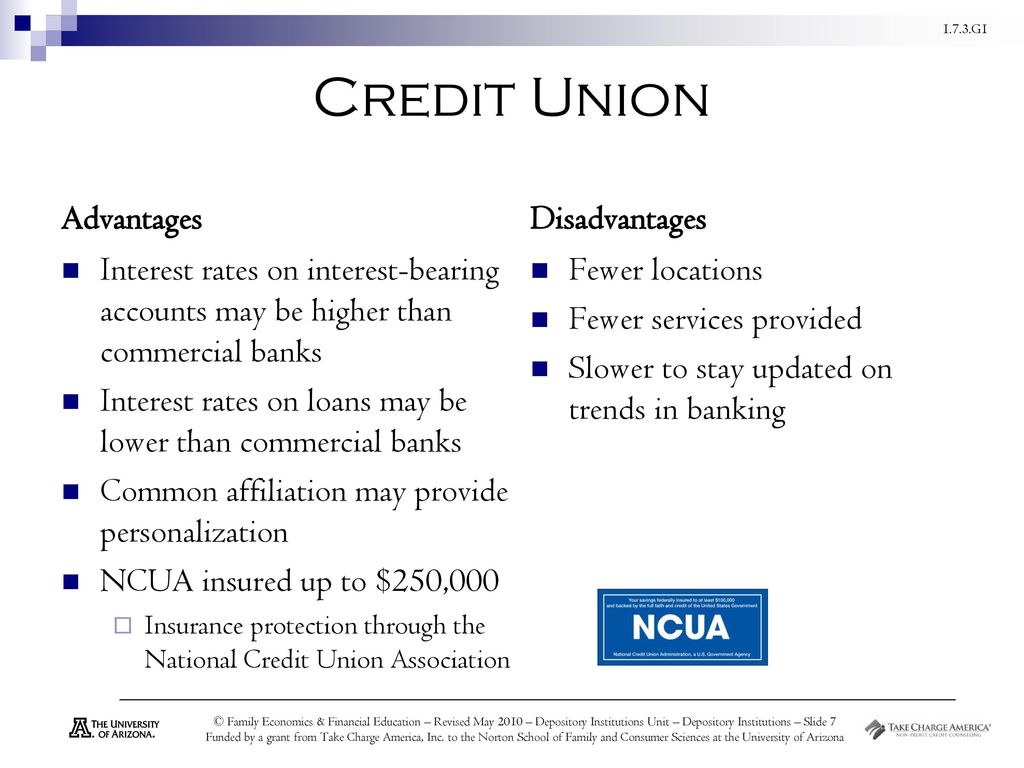

With improved cost savings and inspecting accounts, federal cooperative credit union offer members premium economic items developed to maximize their finance methods. These accounts frequently feature higher rates of interest on cost savings, lower charges, and extra benefits compared to traditional financial institutions. Participants can take pleasure in attributes such as affordable dividend prices on interest-bearing accounts, which assist their money grow faster in time. Checking accounts might offer advantages like no minimum equilibrium requirements, totally free checks, and ATM fee repayments. Furthermore, government cooperative credit union generally offer online and mobile financial solutions that make it hassle-free for participants to check their accounts, transfer funds, and pay bills anytime, anywhere. By making use of these improved cost savings and inspecting accounts, members can optimize their savings possible and effectively handle their everyday financial resources. This emphasis on giving costs monetary items sets federal credit rating unions apart and shows their commitment to assisting members achieve their economic goals.

Reduced Rates Of Interest on Loans

Federal cooperative credit union provide members with the advantage of reduced rate of interest on loans, allowing them to borrow money at even more affordable terms compared to other banks. This benefit can result in considerable financial savings over the life of a lending. Lower rate of interest indicate that customers pay much less in rate hop over to these guys of interest charges, reducing the general cost of borrowing. Whether members need a lending for a cars and truck, home, or individual costs, accessing funds with a federal lending institution can bring about a lot more positive payment terms.

Personalized Financial Planning Provider

Provided the emphasis on improving participants' economic wellness via reduced rate of interest prices on car loans, federal lending institution likewise offer individualized financial preparation services to help people in attaining their long-lasting monetary objectives. These personalized solutions satisfy members' details requirements and conditions, offering a customized strategy to monetary preparation. By evaluating revenue, liabilities, costs, and properties, federal cooperative credit union monetary organizers can help members produce a thorough monetary roadmap. This roadmap might consist of approaches for saving, investing, retirement preparation, and financial obligation administration.

Moreover, the personalized financial preparation solutions provided by government lending institution frequently come with a reduced cost contrasted to personal economic consultants, making them extra accessible to a bigger variety of individuals. Participants can profit from specialist support and experience without sustaining high charges, lining up with the lending institution viewpoint of focusing on members' financial wellness. Overall, these services purpose to encourage members to make enlightened financial choices, construct wealth, and protect their financial futures.

Accessibility to Exclusive Member Discounts

Members of federal cooperative credit union take pleasure in unique access to a variety of member discounts on various products and services. Wyoming Federal Credit Union. These discount rates are a useful perk that can assist members save money on daily visit here expenditures and special acquisitions. Federal credit score unions often companion with sellers, company, and other companies to use discount rates exclusively to their participants

Participants can benefit from discounts on a variety of products, consisting of electronics, clothes, travel packages, and much more. Furthermore, solutions such as auto services, hotel bookings, and enjoyment tickets may also be available at affordable prices for credit union participants. These unique discount rates can make a substantial distinction in participants' spending plans, permitting them to appreciate financial savings on both necessary items and deluxes.

Verdict

In conclusion, joining a Federal Credit scores Union offers various advantages, including enhanced cost savings and examining accounts, reduced rate of interest on fundings, customized monetary planning solutions, and accessibility to special member price cuts. By ending up being a member, people can benefit from a range of economic rewards and services that can help them conserve money, prepare for the future, and reinforce their ties to the regional community.